Local newspapers today are making major headlines again with “the first commercial wave farm of the world”. But for the wrong reasons, the state TV website published an article yesterday with the following opener:

Local newspapers today are making major headlines again with “the first commercial wave farm of the world”. But for the wrong reasons, the state TV website published an article yesterday with the following opener: The three Pelamis machines of the wave farm in Aguçadoura, that was considered by the Portuguese Government as a “flagship” of the country's leadership in renewable energy, where taken out of the sea and have been onshore, at the Leixões shipyard, for 4 months.

The two Pelamis units deployed in September were at sea for only 2 months and there's no date set for a return to operation.

The article continues:

Talking to the news agency Lusa, Rui Barros, from the Companhia de Energia Oceânica (part of the Babcock & Brown group, the project owner) said a recurrent problem was detected with the bearings of the hidraulic jack's articulations in all of the three machines, prompting their move out of sea.

[…]

According to Rui Barros, the continuing problems with these bearings that are submerged, forced the transport of the three machines back to shore by mid November, “so that an inspection could take place”.

“We then verified that the problem was serious an extensive, a generalized problem and not fortuitous.” he explained.

Since then, Pelamis Wave Power, Babcock & Brown's technological partner e maker of these machines, “entailed a discussion” with the company that provided the bearings, being set for April the arrival at Portugal of new parts to repair the equipment.

“I'm awere that there's a team from Pelamis ready to come to Portugal to substitute the bearings”, said Rui Barros.

According to this official, replacing the bearings will take about a month, after which the machines can again be brought to high sea, resuming the testing they were being subject to.

“I'm convinced that, if no other problem brews up, before the end of Summer we shall have the three machines totally free for commercial production. But it is all, if, if, if...”, he said.

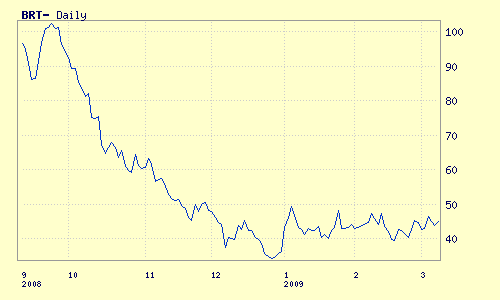

But other problems are menacing the project, the credit crisis is hitting Babcock & Brown hard, that was forced to sell assets to cover its debt, including the Pelamis project. Now it becomes known that the consortium announced in September between this company, tow local ones and another Australian investor was never signed. A second article gives further insight:

[…] the consortium announced six months ago between EDP, Efacec, Babcock & Brown and Pelamis for the development of the Aguçadoura wave farm and of a Portuguese 'cluster' in the field of wave energy never came to be.

[…]

“The initial assumptions of this project were altered and EDP is renegotiating them with Babcock & Brown”, said to Lusa an official from the Portuguese electric company. Underlining that it is still “committed to the project”, EDP didn't clarify if it is interested in buying the stake of the Australian fund.

[…]

On the Portuguese 'cluster' for wave energy, Rui Barros considered it “seriously compromised at the moment”.

The “race” for Portugal's leadership in this renewable energy field is already lost, for if the Aguçadoura wave farm was the first of its genre at the world level, “soon it will stop being so”, concluded Rui Barros.

There are several points worth making on this new development, but first it should be stressed that errors and faults are part of any engineering process. Such is the case for during the architecture phase details are missed and during the implementation phase things not always go as planned. In fact it is the process of testing, error discovery and correction that allows for the improvement of the final product. Knowledge improves when the product fails, not when it works as expected.

Nonetheless, a bearing leakage at this stage seems somewhat strange, especially considering that in situ tests were previously run in Scotland and in Portugal. Speculation can be made that either the bearing provider changed the manufacturing process or that the provider itself was changed in the meantime. In any event the commercial phase of the Aguçadoura project is now running almost 4 years behind the initial schedule.

On a larger scope the compromise of the wave power development 'cluster' is disheartening. And a proclaimed “flagship” project for the country being put at risk by the collapse of an investment fund managed at the other side of the world has its dose of irony. One gets the feeling it was all fireworks and that unfortunately Portugal might not have either the knowledge or the capital to be the “Denmark of wave power”. Being home to the technology and at the moment attracting the investment of E.On, Scotland seems to be righteous owner of that title.

Finally, the reserves I expressed earlier on the maturity of the technology seem to be vindicated by this new development. On the financial front, this new delay almost guarantees that the Aguçadoura project will be a money sink. As for EROEI, every error and fault corrected will improve the design and the assembly and deployment processes, thus also improving net energy. Still it seems now more than justified to at least postpone the 70 million € Aguçadoura II project, until this pilot project reaches an higher state of maturity.

Previously at EuropeanTribune:

The First Wave Energy Farm of the World...It's About Time...

Previously at TheOilDrum:

Tapping The Source: The Power Of The Oceans

Pelamis: A Shot in the Dark?